Your brackets should be in by now. The 2014 NCAA Tournament gets underway in earnest in less than an hour. I think it’s the best three weeks of the sports year. As always, I picked my Duke Blue Devils to win in our family bragging rights bracket. Doing so has served me well in the past.

This year, Quicken loans is offering $1 billion for a perfect bracket, with the prize insured by Warren Buffett’s Berkshire Hathaway. But you probably shouldn’t play, and not just because your chances of winning are so slim. Even so, the lure of playing in a tournament pool is very strong. Millions play — even President Obama plays, if not for money (since it’s actually illegal to do so) — and lots of workers will be less than fully productive for the next couple of days as they try to keep up with what’s going on.

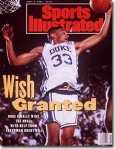

But today I am reminded of 1991. UNLV was the defending champion and came into the Final Four unbeaten and unchallenged. In the national semi-final, the Runnin’ Rebels met my Blue Devils, a team UNLV had destroyed the previous year, 103-73, in the most lop-sided championship game in NCAA Tournament history.

It was U-G-L-Y in 1990 and most people expected more of the same in 1991. Happily, that wasn’t what happened.

But my story today isn’t about the game itself or even the tournament, exactly. In those days, Wall Street trading houses had big tournament pools that featured high entry fees (and thus big prizes for winners) with serious bragging rights at stake. Significantly, because there were lots of traders involved, lots of trading went on. You could call most any major shop and get a two-sided market on any team to win the tournament.

This fact is noteworthy because one particular trader was absolutely convinced that UNLV was going to repeat as champions. More particularly, he was convinced that Duke would not win the tournament and shorted the Blue Devils big without hedging — expecting to profit handsomely when elimination ultimately came. In other words, he was looking to make big money on the trade and not just on the spread. Moreover, losing would mean not just lost potential profits — he would have to ante up real cash. As the expression goes, he was picking up pennies in front of a steamroller.

Our poor schlub was pretty nervous on the Monday after the UNLV upset, but Duke still had to beat Kansas that evening(ironically, it was April Fool’s Day) to win the title for the trader to have to cover his shorts. He feigned confidence, of course, but nobody was fooled. When Duke prevailed over the Jayhawks, 72-65, the fool was six figures (plus) in-the-hole.

Our poor schlub was pretty nervous on the Monday after the UNLV upset, but Duke still had to beat Kansas that evening(ironically, it was April Fool’s Day) to win the title for the trader to have to cover his shorts. He feigned confidence, of course, but nobody was fooled. When Duke prevailed over the Jayhawks, 72-65, the fool was six figures (plus) in-the-hole.

The trader made good — sheepishly and painfully — but the brass learned a lesson. Thereafter, the big firms no longer allowed employees to organize tournament pools and trading on the pools that existed was strictly prohibited. It was even enforced. Rumor has it that this was part of a quiet agreement between regulators and internal compliance officials, who were understandably concerned about what had gone on. Wall Street pools still existed after that, of course, but they were now run exclusively on the buy-side; we on the sell-side still played, but it wasn’t the same. There wasn’t any trading that I’m aware of. And that’s a good thing.

Traders are going to trade. And without careful oversight, position limits and careful hedging, it’s inevitable that people will get in big trouble. That lesson applies to NCAA Tournament pools and to any security you might want to name. It applies to your personal portfolio too.

Good luck to your favorite teams.

Pingback: Thursday links: embedded bias | Abnormal Returns