It was on a Monday, almost exactly 32 years ago, that the stock market suffered its worst day ever. I was still practicing law then, and I was working in my firm office. As the news filtered out (somebody had been out and heard the news on a car radio), the attorneys began to talk about what was going on. As the day progressed and the news got worse, we talked less and less. A senior partner brought out a tiny black and white television to watch the network news coverage, which had broken in to the day’s typical programming of reruns, game shows, and soap operas. We huddled around it and watched.

It was on a Monday, almost exactly 32 years ago, that the stock market suffered its worst day ever. I was still practicing law then, and I was working in my firm office. As the news filtered out (somebody had been out and heard the news on a car radio), the attorneys began to talk about what was going on. As the day progressed and the news got worse, we talked less and less. A senior partner brought out a tiny black and white television to watch the network news coverage, which had broken in to the day’s typical programming of reruns, game shows, and soap operas. We huddled around it and watched.

It was Black Monday: October 19, 1987. Coverage by The Wall Street Journal the next day began simply and powerfully. “The stock market crashed yesterday.”

After five days of intensifying stock market declines, the Dow Jones Industrial Average lost an astonishing 22.6 percent of its value (for its part, the S&P 500 dropped 20.4 percent), plummeting 508.32 points after a 5-year run from 776 in August of 1982 to a high of 2,722.42 in August, 1987. Black Monday’s losses far exceeded the 12.8 percent decline of October 28, 1929, the start of the Great Depression.

It was “the worst market I’ve ever seen,” said John J. Phelan, Chairman of the New York Stock Exchange, and “as close to financial meltdown as I’d ever want to see.” Intel CEO Andrew Grove said, “It’s a little like a theater where someone yells ‘Fire!'”

A closer look at the coverage and its aftermath is revealing, especially for what is missing. There is no “smoking gun.” The Fed later identified “a handful of likely causes.” Then Fed Chair Alan Greenspan has written a lot about Black Monday and about what he did without trying to explain why it happened.

According to the Big Board’s Chairman, at least five factors contributed to the record decline: the market’s having gone five years without a major correction; general inflation fears; rising interest rates; conflict with Iran; and the volatility caused by “derivative instruments” such as stock-index options and futures. Although it became a major part of the later narrative, Phelan specifically declined to blame the crash on program trading alone.

The Brady Commission, appointed by President Reagan to provide an official explanation, pointed to alleged causes like the high merchandise trade deficit of that era, and on a tax proposal that might have made some corporate takeovers less likely. Yet there is precious little evidence to support those claims.

Survey evidence accumulated from traders by the Nobel laureate Robert J. Shiller confirmed generally that traders were selling simply because other traders were selling. It was classic herd-behavior and, essentially, a self-reinforcing selling panic. As Swiller explained, Black Monday “was a climax of disturbing narratives. It became a day of fast reactions amid a mood of extreme crisis in which it seemed that no one knew what was going on and that you had to trust your own gut feelings.”

Here’s the bottom line: the Black Monday collapse had no definitive (or even clear) trigger. The market dropped by almost a quarter for no obvious reason. So much for the idea that the stock market is efficient.

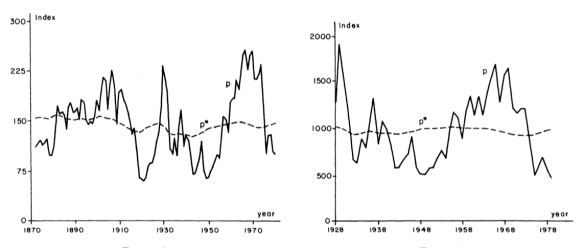

That shouldn’t be news. As Shiller has demonstrated, “The U.S. stock market ups and downs over the past century have made virtually no sense ex post. It is curious how little known this simple fact is.” Here is Shiller’s graphical proof.

Source: Robert J. Shiller

Source: Robert J. Shiller

The charts show prices of the real Standard and Poor’s Composite Stock Price Index (on the left) and the real Dow Jones Industrial Average (on the right) as solid line p, and the ex post rational price (dotted line p*), 1871- 1979, both detrended by dividing a long run exponential growth factor. The variable p* is the present value of actual subsequent real detrended dividends, subject to an assumption about the present value in 1979 of dividends thereafter.

As Paul Singer, of hedge fund fame, noted, “The important turning points in markets are never identified with precision in advance by ‘experts’ and policymakers. This lack of foresight is not surprising, because markets and the course of the economy are not model-able scientific phenomena but rather are examples of mass human behavior, which are never predictable with anything like precision.” In essence, there is all too much complexity, chaos, and chance built into a system of too many variables for us to be able to explain it very well.

While it’s counterintuitive, these observations are wholly consistent with catastrophes of various sorts in the natural world and in society. Wildfires, fragile power grids, mismanaged telecommunication systems, global terrorist movements, migrating viruses, volatile markets, and the weather are all complex systems that evolve to a state of criticality. Upon reaching the critical state, these systems then become subject to cascades, rapid down-turns in complexity from which they may recover but which will be experienced again repeatedly.

It sometimes ends up looking a lot like this.

https://twitter.com/samim/status/685723436606472192

For the markets, this means that we should not expect ever to be able to identify the trigger of any correction or crash in advance or to be able to predict such an event with any degree of specificity, no matter how low interest rates go or how overvalued the stock market is. It probably won’t be, because markets generally go up, for very good fundamental reasons, but tomorrow could be a day that the market crashes. It could even be today! However, you shouldn’t expect to see it coming, and you may not even be able to explain it afterwards.

One can see in charts weakness before any major fallout (exception – initial Brexit shock which luckily reversed 2 days later). No one can predict crash beforehand precisely. But for those who are not so brave, the warnings can be felt every time, just like animals sense natural disasters beforehand. And with study and objective mind, one can steer clear of the danger

There is “weakness” before majors rallies, too. Afterward, it may seem obvious. But nobody does it in real time (except maybe an occasional career-making once in a row).

I remember the crash well. I was in my final semester of college, and the day after the drop, a professor came in to one of my finance classes and said the crash meant none of use were getting jobs. Thanks. (I continued to work two jobs for well after the crash, one in finance.) A similar percentage decline today, would mean a drop of 6,000 points on the Dow. Explanation or not, a 6,000 down day would frighten many people.

Pingback: Opening Bell 24.10.2019 - StockViz

Pingback: Artikel über Trading und Investments 27. Oktober 2019 | Pipsologie