Back in my trading days, we often played What If?, a game that took a real or supposed major event and called on the players to postulate what would happen and, more importantly, what trade should be made in response. In his brilliant and acerbically funny book, Liar’s Poker, Michael Lewis describes playing What If? in light of the Chernobyl disaster and thinking “Buy oil” before being one-upped with “Buy potatoes.” It’s a terrific training exercise, requiring quick and multi-layered thinking.

Back in my trading days, we often played What If?, a game that took a real or supposed major event and called on the players to postulate what would happen and, more importantly, what trade should be made in response. In his brilliant and acerbically funny book, Liar’s Poker, Michael Lewis describes playing What If? in light of the Chernobyl disaster and thinking “Buy oil” before being one-upped with “Buy potatoes.” It’s a terrific training exercise, requiring quick and multi-layered thinking.

An off-shoot of What If? is to ask “What trade hurts the most people,” especially when the market seemed like a one-way street. The idea is not that what seems highly unlikely is necessarily going to happen. Rather, the idea is that when seemingly everyone is racing in one direction, the opposite is much more likely than appreciated and, if and when it does occur, it can do major damage for those who are 180 degrees wrong.

When I was in New York recently, Josh Brown and I were asking that off-shoot question and agreed on the answer. The trade that hurts the most people is the market continuing to grind higher.

We remain in the secular bear market entered in 2000. Such markets generally last 17-18 years. Fed activity has supported the current cyclical bull market beyond what I see as its natural length, with the prospect of tapering providing major market uncertainty. Tapering is obviously a negative sign for the bond market. But what about stocks?

GDP isn’t where we’d like it, obviously, but by world standards it’s pretty good.

Indeed, the economic future looks surprisingly bright (shades are optional), especially if Congress doesn’t get in the way.

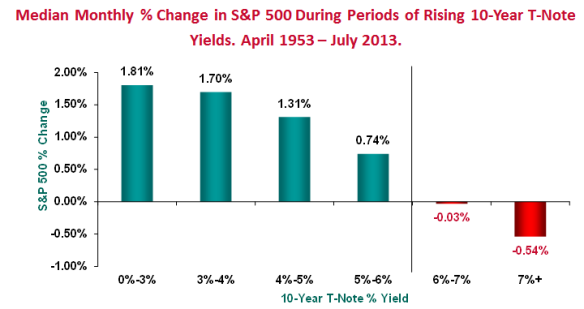

Even so, the market seems convinced that things are really pretty lousy and that tapering is an unmitigated negative even though rising interest rates often lead to higher equity prices.

Jeff Miller and Joe Fahmy, fine analysts both, outline the general bearishness. There is also specific data in the form of the NAAIM (active managers) survey, which shows an astounding plunge in sentiment at mid-week. Moreover, investors yanked $12.3 billion out of U.S. equity funds last week, the biggest outflow in more than five years, according to Michael Hartnett, chief investment strategist at Merrill Lynch. It was the first time in eight weeks that investors yanked money out of U.S. stock funds. Factor in the dreadful performance of hedge funds of late and Hartnett’s note that the bulk of that amount — $10 billion — came from the ETF market’s largest fund, the SPDR S&P 500 (SPY), a frequent repository of “fast” money, and the potential for pain with a higher market becomes even clearer.

I am reasonably confident that another major correction is coming before the end of this secular bear market, but it needn’t come immediately or even all that soon. So beware the market that continues to rally. It’s the trade that hurts the most people.

Pingback: Market Timing | Prudent Trader

Pingback: Tuesday links: one-year performance marks | Abnormal Returns

I completely disagree that an equity grind higher hurts most people. Ask people in India if they are kicking themselves for not having enough in the S&P 500. Maybe investors are a bit light on equities compared to history, but that doesn’t ‘hurt’. Cash is trash is the current trade. Another 100bps spike in real yields would be incredibly painful.

Pingback: Top clicks this week on Abnormal Returns | Abnormal Returns