In early 2000 I was at a big pitch extravaganza for the soon to launch Merrill Lynch Focus Twenty fund. Mother had snapped up star manager Jim McCall from PBHG to start and run the fund which was designed to hold McCall’s 20 best ideas. These were, ubiquitous for the times, all very aggressive growth (and mostly tech) firms, even though the terms of the fund allowed him to invest virtually anywhere. The “focus” idea was to avoid diversification so investors could really make money when the “best ideas” popped, since the fund was to be aggressively traded too. At PBHG, McCall managed its Large Cap 20 fund. In the two and a half years Mr. McCall ran it, that fund raked in average annual returns in excess of 50 percent.

McCall had to wait more than a year to start at Merrill due to a contentious departure from PBHG and the resulting litigation. He had been a successful stock picker and Mother paid a fortune (undisclosed) to win his services. At the time, Merrill was known primarily was a value shop, but McCall was upfront about his lack of interest in valuations or profitability. His focus (so to speak) was the “new economy” — a good story with earnings and growth momentum, albeit from a tiny base. ”Valuation is not one of the factors that enters into our methodology,” McCall said repeatedly.

At the pitch, we were told to get in while the getting was good. Tech was hot and there was lots of money to be made. Risk? What risk? We were pitched hard.

The fund launch was a huge success, with initial assets in excess of $1 billion and an initial share price of nearly $9. And, back then, $1 billion was real money. Assets later exceeded $1.5 billion and the price peaked above $10.

I didn’t buy the fund for myself and I didn’t sell any of it either. At lot of people thought I was nuts but things turned out all right for me if not for McCall.

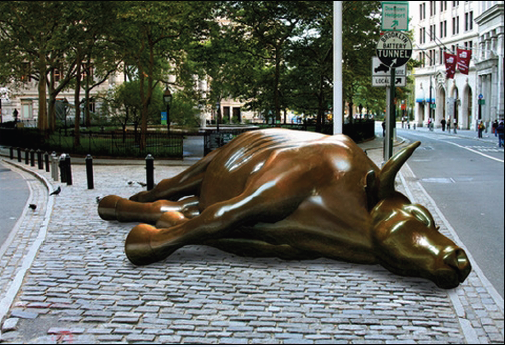

The Focus Twenty launch came at the height of the tech bubble and of the hubris that characterized that time. But barely a year later, Focus Twenty had the ignominious distinction of ranking in the bottom 1 percent among funds of its kind for the previous day, week, month, quarter and year and was down roughly 80 percent. McCall refused to capitulate and kept doubling down on his strategy, all the way to the bottom. Before 2001 ended, McCall was gone and has barely been heard from since.

As Morningstar said at the time, “McCall’s short tenure at Merrill has been an unqualified disaster.”

The easy lesson to draw from the Focus Twenty debacle is the importance of diversification. But what sort of diversification? Market diversification protects against idiosyncratic risk. But without idiosyncratic risk, you might as well hold index funds.

By definition, active managers have clear points of view with respect to what is rich and what is cheap. Concentration (pardon the pun) on selling what is richest and buying what is cheapest is how active managers go about trying to beat “the market” (and it is usually an index that benchmarks whether they have done so). Diversification in that sense means that an active manager is in reality a “closet indexer” and, on account of lower fees, they will find it essentially impossible to beat the market long-term. Active managers want concentration rather than diversification.

However, even the best and most successful active investors make mistakes and have down periods – which can last significant periods of time. This problem is particularly acute during secular bear markets which last, on average, about 17 years. The current one began in 2000, just after the launch of Focus Twenty. During these secular bear markets, equity markets are prone to strong cyclical swings in both directions. In 1977, during a previous secular bear market, Time magazine called this phenomenon a “roller-coaster to nowhere.”

So if you are committed to active management, which favors concentration, how do you avoid disasters like McCall’s? The best way for most individual investors is probably to maintain concentration within investment vehicles while owning such vehicles in at least several market sectors. That said, for individuals and professionals alike, the active management investment process needs to be a very good one to succeed. What’s hot can remain so for an agonizingly long time even though the strategy is anything but a long-term winner. Growth investing worked for a long time during the tech bubble, but valuations matter longer-term. Some approaches and factors have stood the test of time for making investment decisions — such as value, size and momentum. Make sure your activist approach can be supported by the data.

Finally, it is crucial to remember that what’s true in investing today may not be true tomorrow. We must not be capricious and must insist on a careful and data-driven orientation. But we also need to be open to new and better evidence.

As Tadas Viskanta so often says, investing is hard. There are no guarantees. Just ask Jim McCall.

Pingback: Thursday Morning Reads: housing hasn’t bottomed yet « Writings on Wall St

Great post —

It’s truly astonishing that a manager could say ‘valuation doesn’t matter.’ Though I think it’s equally interesting to consider the chart in ‘The Long Cycle’ post you linked to .. if you missed out on the rallies of 1950-1960 and 1985-2000, you missed out on true windfalls. However, the intervening sideways markets provided a lot of opportunity for active managers to lose money.

I’m still trying to figure out how equities fit into a truly diversified portfolio — especially when long-short strategies have had such a difficult time during periods of elevated correlation.