Both of the following statements are ubiquitous among those offering investment products – the first in writing and the second spoken, as enthusiastically as plausibility allows (and then some).

Both of the following statements are ubiquitous among those offering investment products – the first in writing and the second spoken, as enthusiastically as plausibility allows (and then some).

- Past performance is not indicative of future results; and

- Let me tell you about our performance history.

Despite their rank inconsistency, they are presented with respect to the same offering, and even with a straight face.

My job includes listening to sales pitches that invariably include the second of those statements, supported by details prominently displayed in the paperwork while the first statement is buried therein. But if I do my job right, I will focus on the investment process at issue ahead of performance, no matter how much it’s accentuated. But across our industry as a whole, that’s not the way things are usually done.

Data from over 35 years of research on money managers show that they get hired when they have produced superior recent results — mostly after their best-performance years — and get fired right after poor performance. Obviously, simply looking at performance is a convenient and intuitive way to evaluate a money manager. Not only does it focus on the “bottom line” (literally and figuratively), but it is also clear, objective and easy to measure. On the other hand, looking at the investment process is messy, difficult and inherently subjective. But it’s the right way to go, as the following real-life example illustrates.

I received a sales pitch recently about an investment manager that focused upon the following performance claims about its fund and was supported by a lengthy “white paper.” The firm advertises average returns of 9.93 percent annually over the 21 years of the fund’s existence (through 2012), with beta of .03 and a maximum drawdown of less than 5 percent. That’s terrific by any measure. The performance target is said to be 6-7 percent above inflation with drawdowns of less than 3-4 percent.

The purveyor of this fund has also created a leveraged version of the portfolio using the same methodology, for which investors will be charged an astronomical 3.5 percent annually in management fees plus a performance fee of 20 percent of gains, accrued monthly. This fund makes hedge funds look cheap generally (which I would not have thought possible) in that the typical hedge fund now charges decidedly less than the once standard “two and twenty” (2 percent of assets per year plus 20 percent of gains). These excessive fees alone are reason enough to ignore the sales pitch (not to mention that costs are the best indicator of whether a fund will succeed or not). Of course, the firm claims back-tested (hypothetical) average returns of 18.1 percent annually over the ten-year period from 2002-2012 and hopes that a lust for that level of performance will overcome the outrageous fees in investors’ minds. In any event, the desired conclusion is that past performance — in one case real and the other hypothetical — is indicative of future results. But it’s not, as can be readily demonstrated.

This manager’s wares are a particularly good example for process evaluation because that process is so straightforward. The strategy is marketed as an absolute return approach that engages in trend following using just three vehicles — cash, short-term bonds and high yield bonds. There is no equity exposure. Thus returns have been and are predicated upon (a) the ongoing success of the market-timing (“trend following”) mechanism; (b) bond market returns, especially high yield bond market returns; and (c) non-correlation between high yield and short-term bonds. Let’s look at each in turn to see if there is good reason to think that the level of success enjoyed to this point will continue. Unfortunately, there isn’t.

Market timing has a dreadful history, but momentum investing works, is persistent, and has been over all time periods. There is also some reason to expect algo-focused trend-following to work over the long haul (despite recent difficulties). But evaluating such strategies can be difficult or even impossible because the mechanisms employed are typically proprietary. However, since we have good data with which to evaluate the firm’s investment process with respect to (b) and (c), and since that process isn’t nearly good enough, and since there isn’t much “juice” available in the high yield market, we don’t really have to decide whether the manager at issue is a good momentum/trend following investor.

Since the fund provides returns using bonds and cash alone, the next question is therefore whether there is good reason to think that bonds and cash alone will or even can continue to provide annual returns in excess of 9 percent. John Maynard Keynes famously cautioned that the markets can stay irrational longer than one can remain solvent, and it is excellent advice. But whereas stocks can go up forever, at least theoretically, bonds cannot (because there is no yield less than zero). That’s why this manager can’t expect to keep getting the same level of returns.

Overall bond returns over the past three decades (from 1981 until April of this year) have been outstanding due to the following four interrelated factors.

- A secular fall in interest rates and thus a secular bull market in bonds;

- A generally negative correlation between fixed-income returns and equity returns, especially when viewed over longer time horizons;

- Huge fund flows into bonds; and

- Direct support from central banks.

Through April, a diversified bond portfolio, as measured by the Barclays Aggregate index for the U.S., showed solid returns of between 3.6 and 6.0 percent for every period between one and 20 years. But today’s one-year return numbers are in negative territory and represent a drop of more than 400 basis points in less than six months (although things in bond-land are a good bit better today than they were a month or so ago).

The bear market in bonds that has been predicted for so long finally seems to be upon us. If that’s so, bond investors will not only see returns far less than they are used to, they will lose money. And if you’d like some ancillary evidence that the great bond bull market is finally turning over, consider that PIMCO — which rode that bull to over $2 trillion in AUM but has been losing assets of late as bonds have declined — is now embracing alternative investments and entering that market in a big way.

But even if bonds don’t tank for a good long while, the money manager we’re looking at is still in a real fix. At current rates (3-month Treasury bills are yielding 0.03 percent; 2-year Treasury notes are yielding 0.30 percent; and 2-year AA-rated corporate bonds are yielding 0.81 percent), the fund cannot meet its performance target via short-term bonds or in cash as doing so is impossible mathematically. A current coupon 2-year corporate bond could drop in yield to 0.01 percent over the next 12 months and provide a total return of only about 1.6 percent. So the only possibilities for the fund to achieve its historical level of return is via junk or via wildly extreme volatility in which the manager captures essentially all the upside and avoids essentially all the downside. Neither is reasonable to expect.

In the U.S., the modern high-yield-bond market dates back to the 1980s and Michael Milken, and now totals about $1.7 trillion in issuance. Junk, although much more volatile than investment grade bonds, has also seen a long, secular bull cycle.

As the adage puts it, we need to be careful not to confuse genius and a bull market, and the strategy we’re looking at has been the beneficiary of the incredible bond bull market. Since the proffered fund uses only cash, short-term bonds and high yield bonds for its return and since cash and short-term bonds cannot do it, the posited 9.31 percent per annum simply will not continue unless high yield bonds provide it.

In very rough numbers, with current junk yielding roughly 5.75 percent and an effective duration for the market of very roughly 4.5, for high yield to return 9.31 percent over the next 12 months, junk yields would need to decline by about 80bp. And to repeat it the next year, junk yields would need to decline even more. That’s theoretically possible if highly unlikely in the near-term (junk bond yields could decline to levels far lower than ever before seen), but it can’t be sustained over the long haul. Again, it’s not a matter of just being unlikely, it’s mathematically impossible. Wild volatility could do the trick in the manner described above, but there is no reason provided (beyond “trust me”) to think that we’ll see it (or see it often enough) and that this manager can ride those waves.

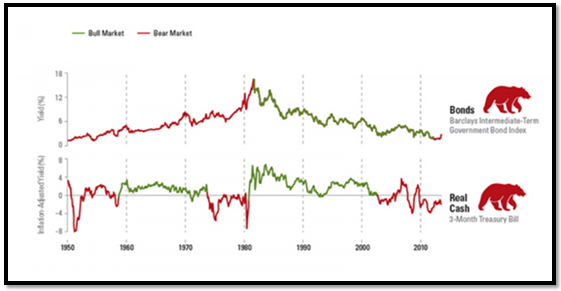

We needn’t really go any further in our analysis, especially if we’re looking to be long-term investors in this fund, but a look at (c), particularly when coupled with (b), makes it a very poor short-term bet too. High yield bond returns, historically, have strongly correlated with stocks while investment grade bonds and U.S. Treasuries provided excellent diversification because of their generally negative correlations, especially since the 2008-2009 financial crisis. Thus a move by the fund away from junk at the right time — when stocks were in trouble — still usually offered solid returns, because (unlike today) short-term bonds and even cash offered reasonable return prospects (see the first chart above).

It’s an overly simple explanation, but when treasuries rallied it usually meant that something was going on that might threaten the economy. Thus during those periods credit spreads would widen and high yield bonds, like stocks, would lose value. When treasuries sold off, it meant the market perceived some relief to whatever problems we were facing, and junk bonds, like stocks, would rally. These market dynamics created a pattern of negative correlation and fit the fund’s strategy perfectly, as shown above.

But more recent events seem to have broken that pattern, likely due to concerns about rising interest rates. The correlation between prices of treasuries and junk bonds, once negative, has turned positive. Thus the easy risk-on/risk-off trade that the fund surely has employed since the financial crisis is no longer anywhere near as easy to implement. Trouble in junk thus now requires a move to cash, and cash is paying essentially nothing and ensuring negative returns in real terms. That won’t produce “6-7 percent above inflation.”

Based upon the realities of potential junk bond returns over the longer term and the changes in correlations in the nearer term, an investor should carefully avoid this fund, despite its excellent 21-year track record. Evaluating the firm’s investment process thus suggests a very different result than examining performance alone.

In a recent Forbes interview, University of Alabama football coach Nick Saban, winner of three of the last four national championships, emphasized that he teaches his players not to think about winning or losing, but rather to focus only on the processes that will lead to success. He calls it “process focus.” If we could invoke such process focus consistently in the investment management business, we would all be a lot better off. Unfortunately, as Morgan Housel cautions: “The business model of the majority of financial services companies relies on exploiting the fears, emotions, and lack of intelligence of customers. The worst part is that the majority of customers will never realize this.” Focusing on past performance when that performance cannot be expected to continue is a great way to keep customers uninformed and the fee merry-go-round spinning for at least a little while longer.

Kudos. Astute and enlightening.

Pingback: 10 Friday AM Reads | The Big Picture

Really skewered them good. A treat to read Bob.

Pingback: Process vs Performance | McBlogger

Pingback: The Wyatt Earp Effect | The Big Picture

Pingback: Beating the Bias Trap (Additional Resources) | Above the Market