I pay a lot of attention to the investment process. In that regard, every investor — personal or professional — ought to have a clear investment plan based upon appropriate personal considerations, goals and outlooks and every investor ought to stick to that plan unless and until something significant changes. But there is a crucial component of the investment process that gets surprisingly little attention: our investment default settings. We can use them when we aren’t sure what to do, when we’re deciding what to do, when our circumstances have changed but our plan hasn’t (yet), or when we’re just starting out.

The idea here is that we all have default settings — known and unknown, acknowledged and unacknowledged — and that those defaults greatly influence how successful we are and become. Having the right default setting in defined contribution plans make a big difference (more here). I would examine and apply my default settings across and throughout the entire investment process and even suggest that we need to look at our default settings as carefully as we look at anything else.

What follows are my suggested default settings. Your mileage may vary.

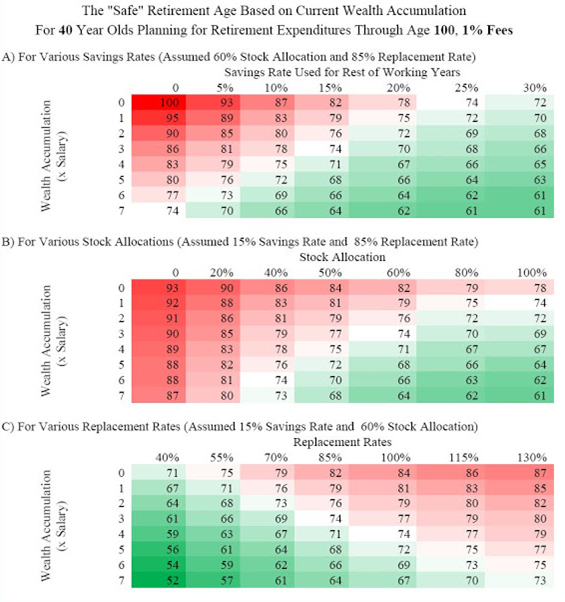

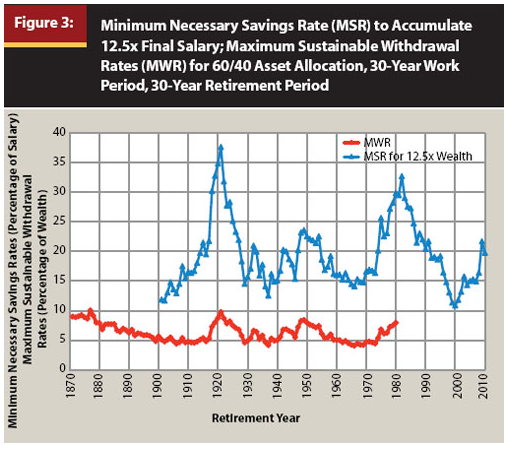

- The most important thing you can do is save. One of the keys to overall success is the ability to delay gratification. Saving is crucial to developing that ability and imperative for anyone who wants to acquire and grow wealth. As investors, we tend to spend far more time on rates of return than savings rates. We shouldn’t. Beginning to save early, doing it consistently, and saving more are far more important over the long-term. My friend Wade Pfau has some very helpful suggestions (more here) for determining your preferred savings rate with respect to retirement. As shown below, 15 percent seems to be a bare minimum assuming 30 years of work. I suggest 20-25 percent as your default savings rate. I recognize that there are often multiple goals for saving (e.g., retirement, a house, children’s education) that are often in tension with each other. I also recognize that saving aggressively isn’t easy. But living with the consequences of not saving is far rougher. Investment success requires saving, saving consistently and saving aggressively.

- Invest you must. As my friend Tadas Viskanta pointed out recently, in the aggregate, cash generally produces negative real returns. Thus holding more cash than would be needed as an emergency fund represents a major opportunity cost. As he wrote in his fine book, Abnormal Returns, “[i]n an ideal world, we could meet our future financial needs by investing in safe, liquid, short-term assets. Unfortunately we don’t live in that world. To generate real returns, an investor needs to take on some risk.” Moreover, there are always reasons to be afraid. But, at best, only a very few (if that) can expect to be successful at market-timing. One need only look at fund return statistics to see that we all have the tendency to buy high and sell low. Have an investment plan, implement it and stick to it. But even if you don’t have a good plan yet, don’t wait to get invested.

- Start passive. In the aggregate, passive investing will outperform active investment on account of lower fees. Passive outperforms active more specifically too and, in any given year, roughly 65 percent of active managers underperform. The Global Market Index (GMI) — a passive, unmanaged but well diversified mix of all the major asset classes weighted by market values — has outperformed nearly everything else over the past decade (see below), providing a 7.2 percent annualized total return for the 10 years ending December 31, 2012. That puts GMI in the 75th percentile relative to the roughly 1,200 multi-asset class funds with at least 10 years of history (and thus makes it an even better performer overall than the 75th percentile suggests once survivorship bias is factored in). GMI’s rebalanced (8.2 percent) and equal-weighted (9.5 percent) counterparts did even better. I believe that active management has a place, even a very important place in an investor’s arsenal of weapons, but the numbers suggest that passive investment be your default setting. Indeed, the vast majority of investors would improve their lot a whole lot by switching to a passive portfolio of low-cost index funds and sticking with them.

- 60/40 is a decent start. Asset allocation is a really big deal. Your asset mix — how you spread your money across stocks, bonds, other investments and cash — has a far greater impact on long-term returns than your individual investments. For many years a portfolio consisting of 60 percent stocks and 40 percent bonds has been seen as the traditional or typical portfolio. An American investor with a 60/40 allocation (there are many ways to do this, of course) has received an average annual return of around 8.5 percent historically. Advisers have been increasingly turning away from the 60/40 portfolio in favor of less traditional asset allocations, according to numerous surveys (including this one from Natixis). Moreover, performance of the 60/40 portfolio over the next 10 years will likely underperform on account of high stock valuations and low bond yields today. Indeed, it is mathematically impossible for the ongoing (but perhaps ending) 30-year rally in bonds to be repeated. There are other reasons to be concerned as well. But research (more here) examining the performance of various assets, including alternative asset classes, when stock performance has been the worst – the bottom 10 percent of the performance spectrum, historically — shows that nearly all asset classes posted losses at the same time that stocks were plunging. That was the case for everything: foreign stocks, real estate investment trusts, commodities, high-yield bonds, emerging-markets bonds, hedge funds, and private equity. There were only two asset classes that had positive returns during those periods: Treasury bonds and investment-grade corporate and municipal bonds. Moreover, the average return for U.S. college endowments — the perceived center of so-called “alternative investing” — was minus-0.3 percent in the 12 months ended in June 2012, badly trailing the stock and bond markets. College and university endowments returned an average of 1.1 percent annually over the past five fiscal years and 6.2 percent over the past decade, net of fees. A simple portfolio invested 60 percent in the Standard & Poor’s 500-stock index and 40 percent in the Barclays Aggregate bond index would have gained 12.6 percent annually over the last three years and 2.8 percent over the last five years, compared with 10.2 percent and 1.1 percent, respectively, for the endowments. There are better and more efficient portfolios, of course (utilizing international exposure too, for example), and you will want to take advantage of the best learning that modern finance has to offer. But the raw data supports the idea that maintaining a basic 60/40 portfolio works well as an appropriate default setting, especially when effectively implemented.

- Be a cheapskate. It is axiomatic that all other things being equal, lower fees are better for investors than higher fees. Indeed, ranking investment funds according to fees (with lower fees being more highly rated) provides the best indicator we have of future performance. Fees matter, sometimes a lot. Cheaper should always be the default option.

- Tax efficient is better. Experienced money managers routinely argue that you shouldn’t “let the tax tail wag the investment dog.” And it’s true that a poor investment isn’t often salvaged by good tax treatment. However, the difference between having a $1,000 gain taxed at the long-term capital gains rate of 20 percent versus the income tax rate of 35 percent would save the investor $150 before considering state taxes and without even using the top income tax rate or noting that other new provisions could hit investment income as well. Individuals with adjusted gross income over $200,000 ($250,000 for joint-filing couples) will face a 3.8 percent Medicare surtax on investment income. Singles who earn over $400,000 (joint filers over $450,000) will face a new top marginal tax bracket of 39.6 percent. Those same people will see their tax rates on dividends and long-term capital gains go up to 20 percent from 15 percent. And limits on itemized deductions and personal exemptions will start to kick in on incomes over $250,000. Details on recent tax law changes are available at the fine blog of Michael Kitces (here). Taxes matter a great deal. Moreover, tax efficiency has not generally hindered performance. According to Lipper, for example, over the 10 years ended December 31, 2012, tax-managed large cap core stock funds returned an annual average of 5.82 percent after taxes while the entire category (which includes hundreds more funds) returned 5.71 percent after taxes. Tax efficiency is the appropriate default setting.

- Don’t forget to re-balance. There are various ways to do it, of course, and the costs of doing so are an important consideration, but re-balancing works (and to a surprising degree). Doing so as a matter of regular practice should be de rigueur.

- Keep it simple stupid (KISS). As my friend Tadas Viskanta emphasizes (as highlighted and supplemented by Barry Ritholtz; the same principle is also noted by the likes of Warren Buffett and Peter Lynch), “[a] simple, albeit less than optimal, investment strategy that is easily followed trumps one that will be abandoned at the first sign of under-performance.” Keeping things simple should be an obvious default setting.

- Have a very good reason to change course. We are all prone to behavioral and cognitive biases that impede our progress and inhibit our success. We are prone to flitting hither and yon chasing after the next new thing, idea, strategy or shiny object. Don’t do it. One way to deal with these biases is to require a really good, data-based reason to change course. In a related matter…

- Haste makes waste. Don’t be in a hurry to make changes even when you are convinced that they are warranted. Losses on account of delay will almost always be out-weighed in the aggregate by more careful and thoughtful analysis keeping you from taking action too soon and without sufficient reason.

Your investment process should include intellectual curiosity, the ongoing pursuit of knowledge, the courage to communicate your views and findings openly, remaining amenable to constructive criticism, and a willingness to move in a different direction if and when the evidence demands it (but not before) and especially if the truths uncovered are at odds with conventional wisdom. Starting with the appropriate default settings can help you get started and keep you headed in the right direction.

Do you have other or different investment defaults to suggest?

Pingback: Bob Seawright: Tax Efficiency Should Be Your Default Setting | The Reformed Broker

Pingback: 10 Mid-Week PM Reads | The Big Picture

Pingback: 7 Articles ETF Investors Must Read: 2/7 | ETF Database

Pingback: 7 Articles ETF Investors Must Read: 2/7 | Beleggen Beurs

Pingback: Saturday links: bothering with bonds - Abnormal Returns | Abnormal Returns

Pingback: Weekend Reading for Financial Planners (Feb 9-10) - Kitces | Nerd's Eye View

Pingback: Invest Like Buffett | Above the Market

Pingback: What’s Your Baseline? | Above the Market

Pingback: Invesstment Advice | Options for Rookies Premium

Pingback: Finance blogger wisdom: a post-Bogle world | Abnormal Returns

Pingback: Happy Blogiversary to Me | Above the Market

Pingback: Updating the Yale Model | Above the Market

Pingback: 2013 Best of the Financial Web | Bason Asset Management

Pingback: 2013′s Best (#3): Financial Advice: A Top Ten List | Above the Market

Pingback: Happy Blogiversary to Me! | Above the Market

Pingback: An End-of-the-Year Best-of Top Ten | Above the Market

Reblogged this on Exploring the World.

Pingback: Happy Hour: Math Behind OJ And Saturday Mail • Novel Investor

Pingback: Happy 5th Blogiversary to Me | Above the Market

Pingback: A Call for Kintsugi Portfolios | Above the Market

Pingback: A Call for Kintsugi Portfolios – extremeconsultingincblog

Pingback: “I’m Joining a Cult!” (said nobody, ever) | Above the Market