Hal Holbrook had a wonderful supporting role in the Watergate saga All the President’s Men, a 1976 Alan J. Pakula film based upon the book of that name by Pulitzer Prize winning reporters Bob Woodward and Carl Bernstein of The Washington Post. Holbrook played the conflicted, chain-smoking, trench-coated, shadowy source known only as “Deep Throat” (over 30 years later revealed to have been senior FBI-man Mark Felt). Woodward’s meeting with his source when the investigation had bogged down is a terrific scene.

Hal Holbrook had a wonderful supporting role in the Watergate saga All the President’s Men, a 1976 Alan J. Pakula film based upon the book of that name by Pulitzer Prize winning reporters Bob Woodward and Carl Bernstein of The Washington Post. Holbrook played the conflicted, chain-smoking, trench-coated, shadowy source known only as “Deep Throat” (over 30 years later revealed to have been senior FBI-man Mark Felt). Woodward’s meeting with his source when the investigation had bogged down is a terrific scene.

Sadly, Holbrook’s iconic line – “Follow the money” – was never spoken in real life and doesn’t appear in the book or in any Watergate reporting. Still, Woodward insists that the quote captures the essence of what Felt was telling him. “It all condensed down to that,” Woodward says. More importantly, it provides a profound truth. Indeed, when asked 25 years later on ”Meet the Press” what the lasting legacy of Watergate was, legendary Post editor Ben Bradlee replied with the words of screenwriter William Goldman, if not Mark Felt: ”Follow the money.” It provides good guidance for reporters generally and really good guidance when one is looking at the financial advice business.

With this important touchstone at the forefront, it’s crucial to recall that the financial advice business generally builds products and portfolios for marketing purposes rather than investment purposes. For the industry as a whole, “results” relate to sales far more than to what investor-clients end up getting. Accordingly, the idea is to play to people’s hopes, fears and prejudices rather than speak the (less marketable) truth. Moreover, if something can be positioned as new, novel or complex — and thus offering a plausible justification for a high fee — so much the better.

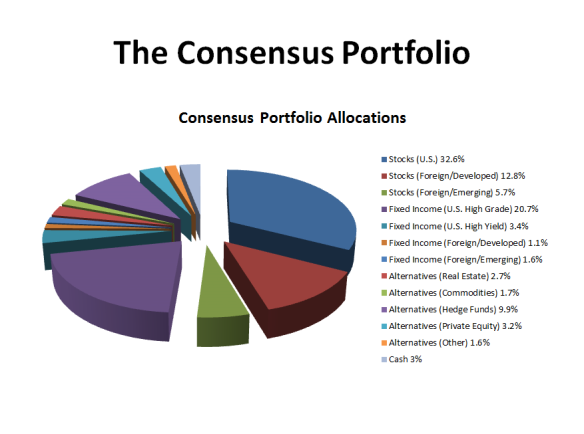

Each year Barron’s polls America’s “top” 40 asset managers and lists the standard, default portfolios of these institutions in general terms. The 2015 edition, reflecting their positions at the end of 2014, was recently published. The aggregate breakdowns of stocks, fixed income, so-called “alternatives” and cash – what I describe as the consensus portfolio — are set forth in the charts below.

Note that the consensus portfolio has a 19 percent allocation to “alternatives” generally and, more specifically, a 10 percent allocation to hedge funds (an investment vehicle rather than a strategy, but representative of a particular sort of investing for the most part), 3 percent to private equity and nearly 2 percent to commodities (mainly gold). This approach owes much to Yale’s David Swensen, whose excellent Pioneering Portfolio Management and amazing stewardship of the Yale Endowment over three decades have created a bull market in so-called alternative investments since the turn of the century.

Note that the consensus portfolio has a 19 percent allocation to “alternatives” generally and, more specifically, a 10 percent allocation to hedge funds (an investment vehicle rather than a strategy, but representative of a particular sort of investing for the most part), 3 percent to private equity and nearly 2 percent to commodities (mainly gold). This approach owes much to Yale’s David Swensen, whose excellent Pioneering Portfolio Management and amazing stewardship of the Yale Endowment over three decades have created a bull market in so-called alternative investments since the turn of the century.

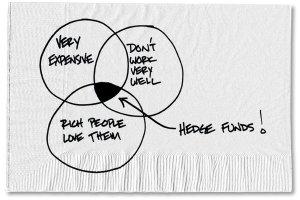

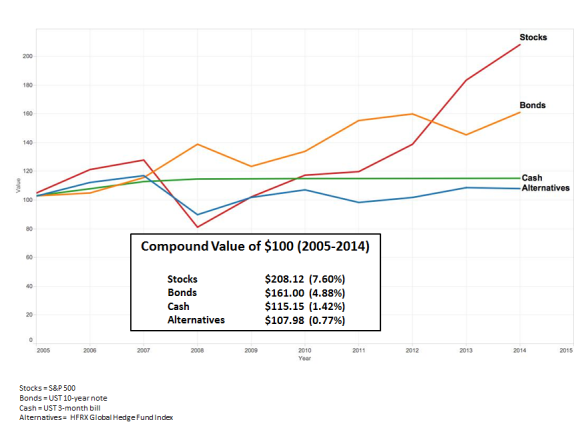

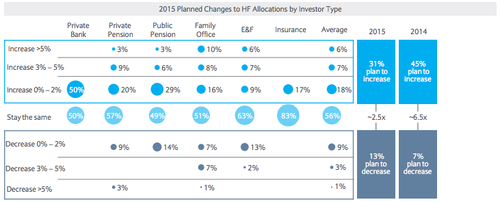

These current allocations exist even though (a) hedge funds and other alternative investment vehicles — despite (and partly because of) enormous fees — have badly underperformed (since 1998, the effective return to hedge fund clients has barely been 2% per year, half the return they could have achieved simply by investing in Treasury bills)(note a fine summary by Carl Richards here); (b) good private equity investments are largely unavailable to the vast majority of us and have been lagging in recent years anyway; and (c) gold may well be the worst investment of all-time (looking pretty but doing nothing). Even so, McKinsey reports that institutional investors intend to either maintain or increase their allocations to alternatives over at least the next three years.

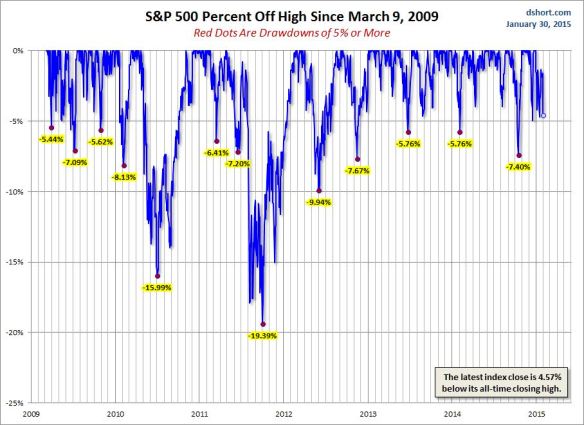

That recent McKinsey report asserts that investors are increasingly disillusioned by traditional asset classes and concludes that the demand for alternatives is driven by powerful structural forces leading investors to seek consistent and uncorrelated risk-adjusted returns. That’s certainly the pitch that’s made. But like “Bubbreeze,” a fictional cleaning product created by the great Tina Fey that masks unpleasant odors but does nothing whatsoever to deal with the real problem, the common pitch tells investors what they want to hear but doesn’t necessarily meet any reasonable objective. As Swensen himself concedes (in PPM), “The most attractive investment opportunities fail to provide returns in a steady, predictable fashion.” Volatility is a necessary consequence of the risk premium afforded by equities (see below).

Investors who want steady, predictable returns need to buy quality bonds and hold them to maturity, despite the opportunity cost of doing so.

Similarly, investors who cannot bear major losses should not be in stocks (Swensen, again in PPM, offers the crucial caveat, since nearly everyone claims to be a long-term investor until times get really tough: “The universality with which investors proclaim themselves long-term in orientation matches only the startling degree to which short-term thinking drives investor decisions”). That said, they should count the cost of doing so as a risk too, albeit a different sort of risk.

The sad reality of human nature is that we want what we want and we’ll follow almost anyone who will tell us that s/he can provide what we want with certainty. Hope and the reassurance that undergirds it matters more to us than reality. Every rational person acknowledges that they make and have made many errors, yet nobody offers current examples. We all want to think that our mistakes are in the past, that we’ve learned from them and that now we’ve set things right. We desperately want to believe that our new approach, new strategy or new portfolio will – finally – be the magic elixir that will make us very good, if not great investors (or at least that we can find those great investors). The alternative investment marketing machine holds out that promise and we are often all too happy to play along.

As Tim Richards explains, we are both by design and by culture inclined to be anything but humble in our approach to investing. We invest with a certainty that we’ve picked winners and sell in the certainty that we can re-invest our capital to make more money elsewhere. But we are often wrong and often spectacularly wrong. These tendencies come from hard-wired biases and from emotional responses to our circumstances. But they also arise out of cultural demands that we show ourselves to be confident and decisive. We love confident certainty and a tidy resolution. Even though we should, we rarely reward those who show caution in the face of uncertainty. We so badly want to believe that we have (finally) figured out the path to investment success that we keep making the same mistakes over and over again.

That recent McKinsey report estimates that (much higher priced) alternative investments will contribute up to 40 percent of the global asset management industry’s revenues by 2020 (if only 15 percent of assets) and asset growth into the alternative space continues despite the lousy performance.

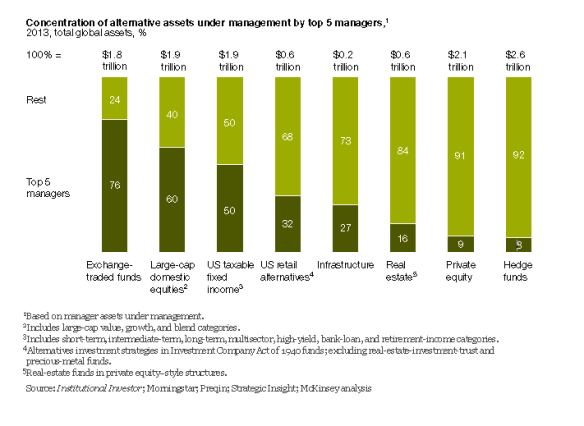

The key (of course) is the higher prices. Follow the money. As traditional investment spreads get tighter and tighter as the industry becomes more automated, commoditized and indexed, of course advisors are looking for ways to increase revenue. The AI universe is a place to do that. Moreover, because the alternative space is so highly fragmented (see below), it is much easier to claim to be offering something different and perhaps exclusive in comparison to traditional investment vehicles, which offers an important marketing feature.

The financial advice industry is much more like the description offered by Liz Lemon (Tina Fey again) channeling Jay Z — a “bunghole where dreams are made up” — than about providing good, substantive, helpful service because the financial incentives for doing so are so great.

But it doesn’t have to be that way. Indeed, many, many advisors routinely provide excellent advice and service to their clients. But the offering of good advice, just like investing itself, demands patience and discipline because so many of the financial incentives in the investment world get behind less than ideal (and often dreadful) products and choices.

Naturally, the AI industry insists that despite some problems, it can offer a magic elixir to improve investment portfolios. The operative issues, of course, are whether alternative investments (generally and particularly) will live up to the hype and whether they will be worth their cost. Charley Ellis, former Chair of the Yale Endowment and long-time Swensen mentor, notes that the “chances that Yale will be able to reproduce what it has done over the past 25 years over the next 25 years are very small at best, probably a negative number. Any institution [or individual] that decides it will follow the Yale model is probably making a mistake.” That’s not a promising start.

The Wall Street Journal‘s Jonathan Clements argues that investors are drawn to alternatives out of risk aversion. “Investors are desperate for something that will protect their portfolios the next time stocks sink.” However, investors who do so ought to bear 2008 in mind since hedge-fund losses that year came to about four hundred and fifty billion dollars (more than 20 percent) — considerably more than all the profits that the hedge fund industry had generated in its entire history to that point. In this respect, the industry hopes and prays that past performance is not indicative of future results. We should be very skeptical about claims that the hedge fund industry can indeed “protect the downside” next time.

Swensen and the so-called “Yale Model” became the focus of much attention on account of its performance during the tech bubble. From July 2000 through June 2003, while the S&P 500 fell 33 percent, Yale’s endowment actually gained 20 percent. Yale’s portfolio continued to perform well until 2008 (returns of 19.4 percent in fiscal 2004, 22.3 percent in fiscal 2005, 22.9 percent in fiscal 2006, 28.0 percent in fiscal 2007 and 4.5 percent in fiscal 2008 – through June 30, 2008). However, the poor performance of the fund and others like it during the financial crisis beginning in 2008 precipitated some intense questioning of the Yale Model. Yale lost 24.6 percent in its fiscal year 2009 (compared to an S&P 500 loss of roughly 26 percent over that time).

Swensen’s own research (outlined in the Endowment’s 2010 Report) disclosed the extremity of the risks associated with the Yale Model, which relies upon alternatives more than any other approach. Swensen concedes that the “average endowment” runs a 28 percent likelihood of losing fully half of its assets (in real terms) over 50 years based on its asset allocations and a 35 percent risk of a “spending disruption” over five years.

Clearly, the Yale Model postulates a very high risk portfolio that has performed admirably (Yale has earned 13.9 percent annually over the past two decades). Yale uses its perpetual time horizon to take maximum advantage of the equity risk premium and the illiquidity premium to seek out maximum long-term returns. That said, Yale’s performance since the financial crisis has not regained its prior heights. Indeed, it has been decidedly lackluster, suggesting more than a temporary down cycle (mean reversion) is at work. I think that the sector is overcrowded. In fiscal 2010, Yale achieved 8.9 percent return while the S&P 500 gained 12 percent. In fiscal 2011, Yale earned 21.9 percent, roughly even with the S&P 500. In fiscal 2012, Yale earned 4.7 percent, less than the S&P 500’s 5.5 percent over that time. In fiscal 2013, Yale earned 12.5 percent, far less than the S&P 500’s 20.6 percent. And in fiscal 2014 (ending June 30, 2014), the most recent period for which data is available, Yale earned 20.2 percent., decidedly less than the S&P’s nearly 25 percent gain.

To be fair (as I have explained before), a highly diversified portfolio will sometimes underperform a domestic large cap index and there is nothing necessarily wrong with doing so. However, Yale’s recent lag in performance is indicative of how hard it has become to make money in the very crowded alternative space, as Yale itself recognizes, even though Yale has access to many more great alternative managers at lower costs than the rest of us.

This general change in the performance landscape has motivated the alternatives industry to move the goalposts. Early on, before actual results caught up with them, the story was all performance. Then, when that story wouldn’t sell any longer (the numbers were too bad), it became non-correlation and risk avoidance (see here for the best argument of this sort), as the Jonathan Clements comment above indicates. But a lack of correlation only during periods where the traditional markets are strong doesn’t help much. Assurances that AI will work well during the next correction/bear market are (shall we say) problematic when they didn’t work very well in 2008-2009. “Trust me” is not a great sales pitch, even when it works. Moreover, at some point even terrific non-correlation doesn’t help if and when the performance is sufficiently lackluster.

No doubt there are some excellent alternative asset managers and investments. The idea behind alternative investing is a good one. But, in the aggregate, by this point it should be clear that most alternative investment vehicles are less a vehicle for managing assets and more a vehicle for acquiring assets and fees.

Some people are catching on. The pension giant CalPERS and others are leaving the space. But the AI sector is still growing at an astounding rate.

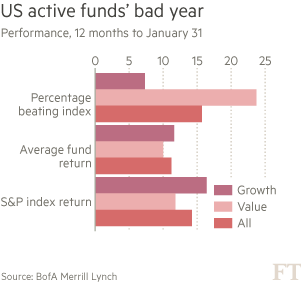

The active management business is no longer able to sustain the argument that it provides value in an aggregate sense (right), despite some excellent managers, approaches and strategies. Even though the average active manager outperforms a bit before fees, fees more than eliminate the advantage (which explains why money is hemorrhaging out of active managers and into low-cost vehicles). Indeed, there is a really good argument to be made that fee avoidance is the most important characteristic in investment success even though and as advised portfolios perform better than those of the unadvised and even Vanguard estimates (via a new study) that advisors can provide substantial value to their clients. These realities create an inherent conflict. Good financial advice is highly valuable but — remarkably if unsurprisingly — it’s not what much of the financial advice industry chooses to sell…because other things pay better.

The active management business is no longer able to sustain the argument that it provides value in an aggregate sense (right), despite some excellent managers, approaches and strategies. Even though the average active manager outperforms a bit before fees, fees more than eliminate the advantage (which explains why money is hemorrhaging out of active managers and into low-cost vehicles). Indeed, there is a really good argument to be made that fee avoidance is the most important characteristic in investment success even though and as advised portfolios perform better than those of the unadvised and even Vanguard estimates (via a new study) that advisors can provide substantial value to their clients. These realities create an inherent conflict. Good financial advice is highly valuable but — remarkably if unsurprisingly — it’s not what much of the financial advice industry chooses to sell…because other things pay better.

On account of historically low interest rates, investors who need (or want) low risk options that provide decent yield have been put in a really hard position. The alternative investment space (and hedge funds in particular) has tried desperately to fill this demand. And where reliable information is difficult to obtain, it’s easy to see how investors might mistake effective marketing and high costs for real quality. Yet the entire concept of lower absolute returns but higher risk-adjusted returns is dependent upon a highly questionable conceit — the idea that risk and volatility are the same thing.

What the hedge fund folks and the AI folks say they are selling is (relative) certainty and high-end analytics for which customers will pay dearly. You get what you pay for, they say. What they are actually selling is hope, exclusivity, novelty and access for which customers will pay dearly. As John Bogle so astutely puts it, due to the drag high fees place on one’s investment portfolio, you get precisely what you don’t pay for.

There is very good reason to think that the hope so many have in alternative investments is often misguided. Yet we desperately want to believe. We love certainty too. And we really love exclusivity. Instead, we’d be wise to follow the money. When we get to rainbow’s end, will there be a pot of gold there or will the financial advice community have already pocketed it and moved on?

Pingback: 03/20/15 - Friday Interest-ing Reads -Compound Interest Rocks

Bravo! An extremely well articulated treatise on the alternative investment universe and their minions. Excellent references/links. Simply cannot bestow enough accolades to the author(s) and this publication. Well done!

I’m sorry (and I really do agree with the idea of this article) but this is pure click baiting on a very well worn topic without the slightest bit of research behind it. Firstly you insult gold, but have you looked at the actual returns? Gold has been a great, uncorrelated investment producing positive returns year in, year out including 2008. Someone who was diligent about rebalancing a diversified portfolio including gold has done much better for a LONG time now that one with a portfolio without gold. I dare you to pei the yearly returns of gld (not the best but the easiest vehicle to invest with).

Second you use a joke of a hedge fund index and an arbitrary point in time to test. Again, I don’t think the point you’re tryjng to make changes, but at least be intellectually honest. You claim hedge funds are just a structure (which is true) but are happy to use the (worst possible) Hf index to prove a point. Why not try to compare to an actual hedge fund (you can probably find the returns of a fund like och ziff, the “ibm” of hedge funds that is always open and a standard investment for many institutions like Yale. That would be an honest way of making this argument, but you seem to have no interest in expanding this debate, just rehashing tired arguments.

Anyway, most institutions should not invest in most hedge funds. But this type of lazy mathematics and reporting need not be followed.

Pingback: Everybody Plays the Fool (Sometimes) | Above the Market

Pingback: Carrick best reads: How we got duped into believing diamonds are special | topfinancialnew

Pingback: Happy Blogiversary to Me | Above the Market

Pingback: Are Alternatives' Assets Here to Stay? - RCM Alternatives

Pingback: Alternative Investments: Follow The Money?